Mae Manee QR Code Payment

Introduction

Mae Manee QR Code Payment allows your merchants to create orders that accept a QR code that their customers may use to pay for them. Customers can make bill payments (QR Tag 30) and credit card payments (QR CS) using a mobile banking app and Alipay or WechatPay E-wallet, and merchants will be notified when the payment is completed.

Currently, Mae Manee QR Code Payment are classified into the following categories:

1. Thai QR Code Tag 30 (QR 30) - This is to support merchant-presented mode (C scan B) QR codes, in which the customer scans the merchant's QR code and pays with either a current or a savings account. Most major Thai banks accept this type of QR payment.

2. QR Card Scheme (QR CS) - This is to support merchant-presented mode (C scan B) QR codes, in which the customer scans the merchant's QR code and pays with a credit card. QR CS is currently supported by VISA, Mastercard, and UnionPay, making it globally compatible.

3. Alipay and WeChatPay - This is to support merchant-presented mode (C scan B) Alipay or WeChatPay QR codes to tourist customer segments and expand their payment options so that the merchants can effectively tap into this market.

Note:

See more details

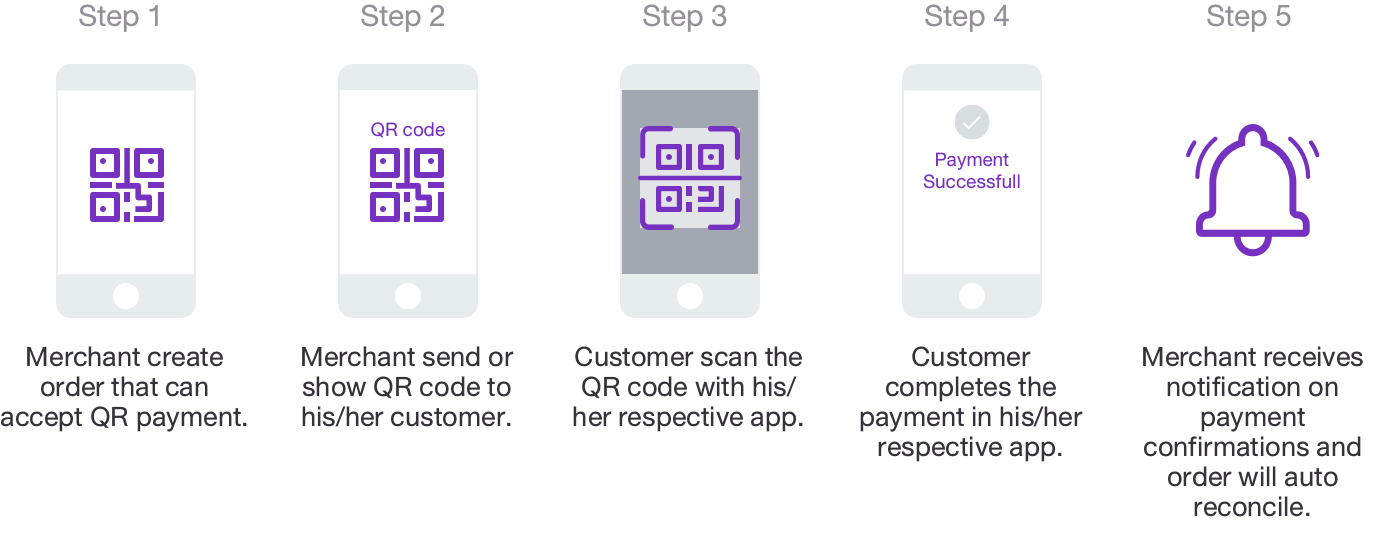

User Journey

Inquiry Transaction Detail After the customer pays successfully, if a merchant would like to check the transaction status, they can use the inquiry function by using Wallet ID, Partner Reference No, Order ID, Channel and Request ID .

Inquiry Transaction History After the customer pays successfully, If a merchant would like to check many transaction status, they can use the inquiry function by using Wallet ID, Channel , Start Date , End Date , Request ID , Page and Pagesize

Note:

Payment Confirmation

After the customer pays successfully, Mae Manee App will send a payment confirmation to Merchant's registered URL. All onboarded merchants may provide a payment confirmation endpoint.

Note:

Endpoint

- QR 30 : The endpoint is registered per ref 1, ref 2 as Wallet ID, ref 3 (Terminal ID).

- QR CS : The endpoint is registered per Merchant ID.

- SCB EASY App payment with bill payment type (BP) : The endpoint is registered per ref 1, ref 2 as Wallet ID, ref 3 (Terminal ID).

- SCB EASY App payment with credit card full amount type (CCFA) : The endpoint is registered per Merchant ID.

- SCB EASY App Payment with credit card installment payment plan type (CCIPP) : The endpoint is registered per Merchant ID.

- Alipay WeChatPay : The endpoint is registered per Merchant ID and Terminal ID.

APIs

1. QR Code Generation

API Initiator : Partner/Third Party

API Recipient : SCB

The API for QR code generation supports QR 30, QRCS, ALIPAY, and WECHAT. Partners can choose to generate. An example of triggering such this API call is when a merchant creates an order and would like to generate QR in order to send the QR to the end customer.

2. Payment Transaction Inquiry (Per Transaction)

API Initiator : Partner/Third Party

API Recipient : SCB

The API can be used by partners to inquire about the transaction status and perform verification on the transaction. An example of triggering such this API call is when a payment confirmation was not received by the partner.

3. Payment Transaction Inquiry (Historic Max 30 Days)

API Initiator : Partner/Third Party

API Recipient : SCB

After the customer pays successfully, if a merchant would like to check the transaction status, they can use the inquiry function by using Wallet ID, Payment Date Time From and Payment Date Time To.

Note

- The ability to support the order status (bulk) must be within 3 months from the current date.

- The ability to support the order status (bulk) must not exceed 30 days per inquiry.

- The ability to support the order status (bulk) is pagination, 50 records per page.

Prerequisites

- API Authentication – Required

- Type of Authentication – OAuth token

- OAuth Grant Type – Client Credentials

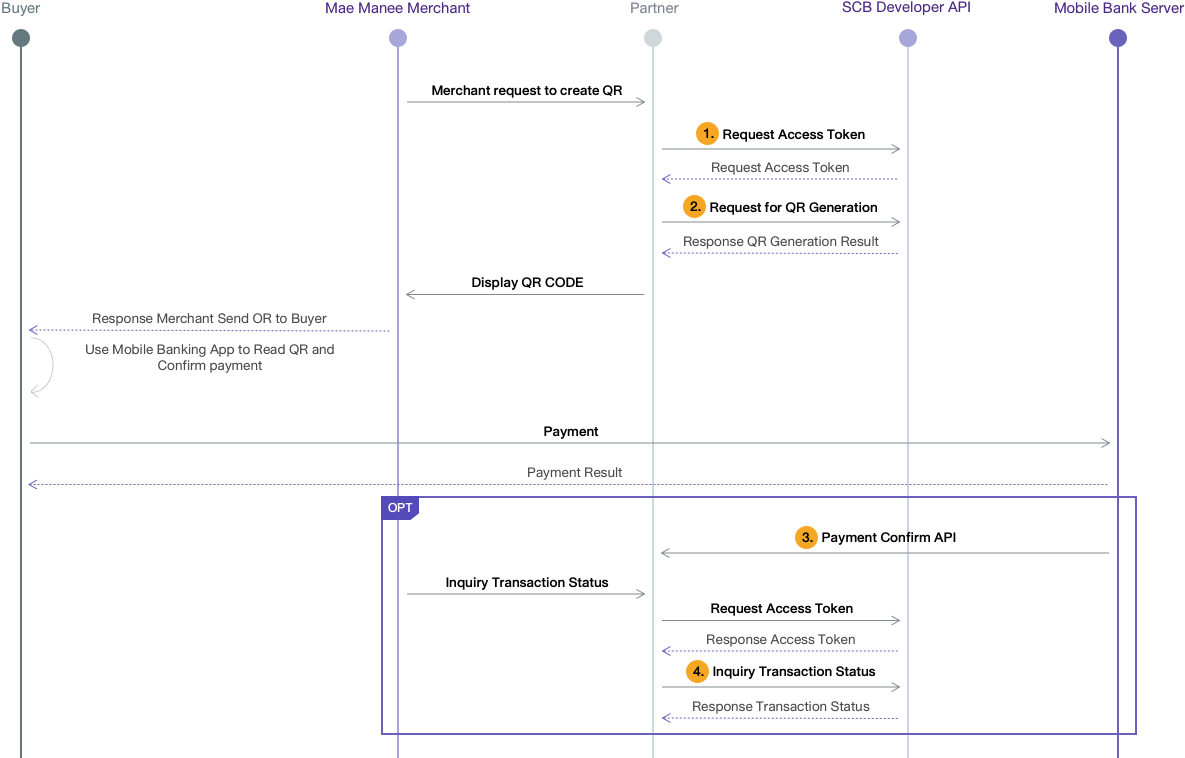

Technical Flow

| Seq No. | API Name | API Endpoints |

|---|---|---|

| 1 | Generate Access Token | POST /v1/oauth/token |

| 2 | QR Code Generation | POST /v1/maemanee/payment/qr/create |

| 3 | Payment Confirmation | - |

| 4 | Payment Translation Inquiry | POST /v1/maemanee/payment/transaction/getone |